The Future of Streaming Monetization: Beyond the SVOD/AVOD Divide

All too often, the monetization discussion revolves around a simplistic binary that expands only slightly on the old ad-supported broadcast model for home-based media and entertainment: subscription vs. advertising. And the intrusion of hybrid and ad-based models where SVOD once reigned—as in Netflix’s announcement of an imminent ad-based tier—is widely interpreted as a sign of the apocalypse, or an indication that SVOD’s days are numbered. But the game is more complicated and more fluid than that—and not just because gaming consumes a sizable enough chunk of home entertainment time and investment that can’t be excluded from the conversation, even though it doesn’t fit neatly in the AVOD/SVOD binary.

Meanwhile, savvy publishers, rightsholders, and streaming services see a more nuanced landscape. Gamification, interactivity, merchandising, and direct-to-consumer apps let both publishers and advertisers super-serve fans with content that goes beyond live linear or VOD.

Is Overall Subscriber Spend Sagging?

One of the key questions in streaming monetization from a subscription standpoint is what viewers are paying and what they’re willing to pay for streaming subscription, with the natural conclusion being that as those numbers go down, streaming services and content owners must find a way to compensate via other revenue streams and strategies.

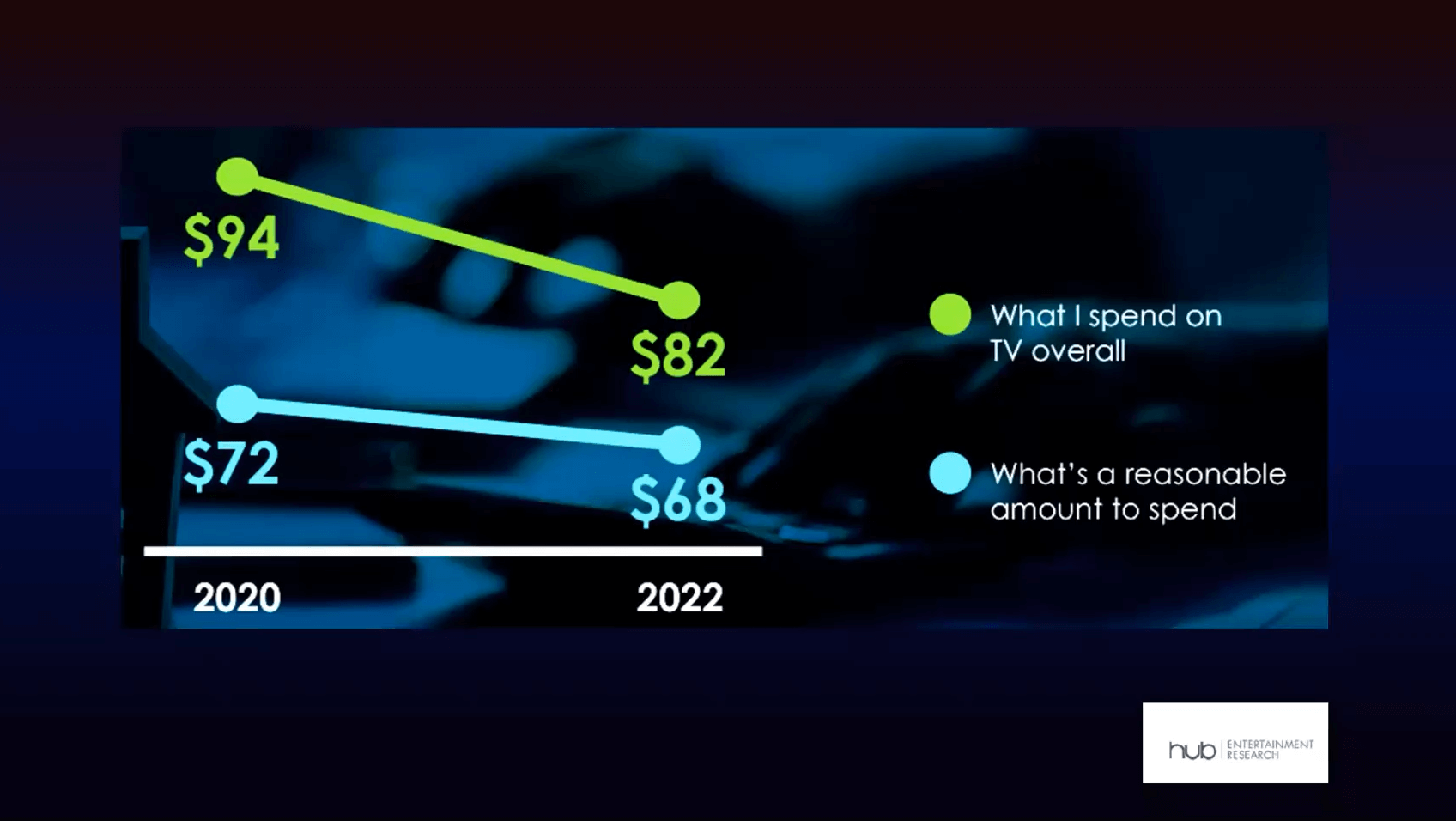

In two surveys of streaming users, the first conducted in 2020 and the second in 2022, Hub Entertainment Research asked participants how much they spend on TV services overall, and how much they believe they should be spending. In 2020, those numbers were $94 and $72, respectively. In 2022, the totals dropped to $82 and $68 (Figure 1). According to Hub Principal Jon Giegengack, this signifies not only that viewers are tightening their belts, but also that they’re getting closer to their target spend, suggesting that “people are taking advantage of today’s more diverse TV marketplace to pick and choose things that they really get some value out of and get their spending down closer to what they feel they ought to be spending and spend less on stuff that they don't watch.”

Figure 1. Hub Entertainment Research findings on real and preferred TV spends, 2020-22

What’s behind the numbers, of course, is not entirely clear. Are viewers watching less content, confining their viewing to fewer subscriptions, churning more quickly as they exhaust the shows they want to watch on a given service, or are they actually shifting their viewing to more free channels?

“I think it’s a combination of things,” says Trusted Media Brands VP of Global Revenue Operations for CTV & Digital Mike Richter. “Regardless, people pay for content, with money or with time. Before, in a primarily cable-based world, you were paying with both–paying for a subscription with significant amounts of advertising." With today's ad-supported services, he says, "maybe there's a better balance because we've reduced the average number of ad breaks in a FAST or AVOD environment, and average length of time [spent on ads] in those environments as well.”

Putting a Price on Viewing Time

Hub Entertainment Research also gathered data around user satisfaction with premium, ad-free versions and ad-supported versions of the same services, and got some fairly surprising results, which explain a lot about why AVOD and FAST (as well as what Shapiro calls “SAVOD” hybrid OTT monetization models) are on the rise.

“For some platforms like HBO Max, satisfaction is a little higher for people who watch the ad-free version than those that watch the ad-supported,” Giegengack says (Figure 2). “But for services like Discovery, it’s the other way around. So, the takeaway if you aggregate across them all is that tolerance for ads is a lot higher than many people expect it to be. As the ad experience gets better, and people are stacking more and paying for more subscriptions, the willingness to use ad-supported platforms is getting higher and higher.”

Figure 2. Ads vs. no-ads tiers at HBO Max

“Back when OTT was taking off, everyone was thinking they wanted to eliminate advertisements,” Richter says. “But all of the studies done then mirror the studies that are being done now. People expect to pay for their content with time. Now, we would think that, if we reduce the amount of advertising time, in theory that should be more valuable than what you're seeing in a linear based environment or video environments. But what we've not solved yet is a consistent centralized measurement of that exchange. The expectation is we should see an increase in value, but it's hard to justify that, and that's when we need to solve for next.”

“When we asked people how much they can tolerate advertising, even the people who described themselves as the most ad-intolerant gave us really interesting answers," says Giegengack. “When we asked, 'If there was a choice between two platforms, one of them's ad-free and it costs $4-5 a month more than one that you have to watch with ads, a third of the people who [described themselves as] the most ad intolerant said that they would choose the ad-supported version if it saved them $4-$5. So the thing that people mind about advertising is not the ads themselves; it's the traditional live TV ad experience where there's really long ad breaks, and a lot of the ads have nothing to do with you. That experience has only become more jarring as people compare that to how advertising on every other part of the internet works, where the ad loads are pretty small and they're targeted directly to you. As the ad experience improves, it becomes a much more reasonable compromise than paying for the ad-free platforms.”

Shapiro agrees that contextualization and targeting are essential to making advertising tolerable. “One of the keys to this is making the content and environment specific to the person enjoying it,” he says. “If that experience is good enough, it doesn’t matter how many ads there are.”

What Gaming and the Creator Economy Reveal About Monetization

OTT, FAST, and AVOD services, naturally, are not the only content providers turning a profit in the streaming world. Where the revenue comes from in other venues is less obvious, but no less relevant–particularly for the potential crossover appeal of successful streamers’ approach on Twitch, YouTube, and other platforms serving the creator economy.

“There's also the live streaming aspect of it with the Twitches and YouTube Lives and Instagrams of the world, with billions of hours of content being viewed every quarter,” says ESHAP CEO Evan Shapiro. It's free, but somebody's making money off of it. But they seem to be as desired and as 'must-have' to certain consumers as the premium OTT services, depending on who they are.”

"I work with a lot of people in the 13 to 25-ish demographic, teaching at San Francisco State and working with a lot of independent content creators. These are people who want to monetize via micro-donations, and they are taking advertising via developing sponsorship deals. I think there's a lot that traditional or premium channels can learn from that," says Dina Ibrahim, Professor of Broadcast & Electronic Communication Arts at San Francisco State University. Regardless of the platform, she says, "If they have a show, and they have stars on that show, and they want to make additional revenue, they really should be tapping into Twitch, which does have a massive audience. Another opportunity with Twitch and YouTube Live and Instagram is merchandising. You're seeing a lot of even younger kid–nine to 13–really wanting to spend money on merchandise related to the shows they watch. YouTuber merch is a big, big, growing market. I tend to look at younger audiences to see where those trends are going to lead us. They're not making the purchasing decisions per se in terms of subscriptions, but I do think that Twitch and YouTube Live are offering a lot there” (Figure 3).

Figure 3. A YouTuber merch store

Barrett-Jackson Auction Company CTO Darcy Lorincz argues that it won’t be long until click-to-buy monetization techniques pioneered at Twitch and elsewhere flood the premium content world. “If you look at the Twitch experience,” says Lorincz, “you can buy things. You can earn loyalty points. You can give things to the programmers. It's all there in Twitch now. Amazon Prime is gonna start doing that same thing with sports-related and television-related content. Embedding the ability to monetize right in the programming or adjacent to it is very powerful. I see it spilling over into all the other experiences, whether lean-forward or lean-back. With 3 billion-plus digital natives and gamers” who expect to have these interactive opportunities as part of their entertainment, “it's just gonna come at you. You're not gonna have a choice to do it or not."

“Disney has always been really good at squeezing out any monetization strategy possible,” says Ibrahim. “Merch is huge. And the second thing that Disney does really well is experiences, creating real-life experiences around the virtual experience of the content. For gaming, that's gonna be an increasing part of it. You've got eSports arenas popping up. You've got people physically coming together to experience gaming, which they're doing in their bedrooms. I think the combination of experience and merch, has to be part of the strategy, and that's where Netflix is losing out. It’s just such missed revenue out there. That drives me nuts.”

Shapiro agrees that one need look no farther than online gaming to see a place where constant click-and-buy monetization has become an integral part of the experience. “It's happening in Roblox. It's happening in Fortnite. People are clicking and buying instantly, because there’s zero friction. I click it, I buy it. I have it immediately. There's no delayed gratification."

But when it comes to translating this strategy to video, Richter argues, "I think there's a deeper foundation to focus on to get to that point. How much do they care? How much does the content drive their deeper connection of emotion, to where if they see a designer partner up with somebody in one of our shows, they gonna want that outfit or that designer made? It's not always about throwing the logo on the shirt. I love a great Disney shirt with a logo on there, but when you think about the fantasy that Disney creates, for example, the princess dresses or the shoes, and then you start seeing designer clothing that's modeled after those dresses or after their shoes or after those outfits that the princess wear, that's what drives that emotion and that connection.”

Related Articles

The streaming business model must change. Services that rely solely on subscriptions are going to plateau. They will have to continually return to their subscriber base and "milk" them for additional revenue via fee hikes. But by taking the plunge and embracing advertising as the primary part of creating and supporting quality television, streaming services will meet the ultimate need of their viewers: getting to see the content they want.

21 Jan 2025

What does the future of streaming monetization look like? This post-Peak TV media ecosystem is a brave new world, and being able to find the content you want, with the price you want to pay, will likely keep consumers on their toes for years to come.

04 Apr 2024

Streaming media business and monetization models expanded and diversified in 2022 and sent a clear message: Paid subscription models were a necessary gateway to widespread streaming adoption, but now ad-supported viewing has a chance to flourish.

12 Apr 2023

Lightcast CEO Andreas Kisslinger explains how OTT publishers can pursue "beyond the beaten path" strategies for boosting ROI and how Lightcast can help in this interview with Streaming Media's Tim Siglin at Streaming Media East 2022.

05 Jul 2022

Are cord-cutting and FAST driving OTT growth in 2022? Roku US Head of Verticals Jessica Masters discusses OTT monetization and emerging viewership and adoption trends in OTT in this interview with Streaming Media's Tim Siglin at Streaming Media East 2022.

28 Jun 2022

Bulldog DM's John Petrocelli and LiveX's Corey Behnke discuss the explosion of ecommerce in streaming that's booming overseas and increasingly coming to North America, and the emerging opportunities for maximizing revenue with interactive streaming in this clip from Streaming Media East 2022.

17 Jun 2022

Zixi VP of Business Development Eric Bolten discusses how to apply AI to an organization's future-setting monetization and cost goals with better metric, targeting, and personalization in this clip from Streaming Media Connect 2022.

16 May 2022

Amagi SVP Mike Woods identifies the "Three Horsemen of the Streaming Apocalypse" and what they reveal about the future of the streaming industry in this clip from a panel at Streaming Media West Connect 2021.

18 Nov 2021

Companies and Suppliers Mentioned