Blue Coat Optimizes Video on Enterprise Networks

Much of the talk around the streaming media industry revolves around encoding tools, players, content delivery/distribution networks, video servers, and more recently, online video platforms. Many of these face serious scaling challenges, and these scaling issue push the limits of the technology. The technologists among us like to dwell on the nuances of how these work and fit together, how they may reach larger and larger mass markets, and how they might innovate in more and more competitive ways.

What we often forget is the more rarefied sector that involves managing video in the enterprise network.

I tracked down Nigel Hawthorn, who is the VP EMEA Marketing for Blue Coat Systems in response to an interesting press release highlighting the launch of a new version of their ProxySG appliances, which enable RTMP splitting (proxy for Flash streaming). Since the press release was clearly written for an audience much wider than our industry, I don't feel I need to reiterate their points about the expected scale of growth of online video that is anticipated in the next few years. This audience knows that.

Instead I think it is interesting to understand the company's journey and its focus on the enterprise (and also the carrier) space, and to see why online video is a critical factor in their growth.

I also think it's interesting to get the ball rolling by pointing out that with annual revenues of $500 million, they revenue a little more than Limelight and a little less than Akamai.

Let's start by looking at where they came from, then peer into why and how they got involved with streaming, and finally take a peek at how the future looks from their perspective.

History

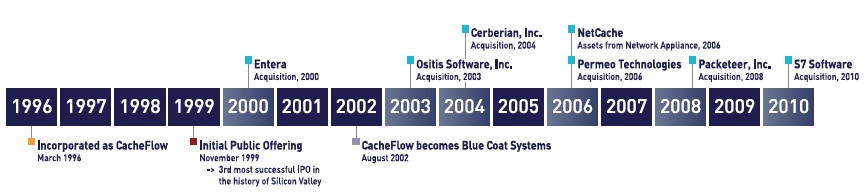

The image below was taken from Blue Coat's corporate website, and it neatly chronicles the company's evolution since 1996.

In 1996 the company was founded under the name CacheFlow. In the dot-com days it was perceived that there would be a growing need for network optimization technologies since, with the emergence of the Internet on expensive long distance telecommunications links, there were many benefits to Carriers in being able to ‘Proxy' content, and avoid reutilization of those expensive links for requests for the same items of content. At the time, because streaming was very much a nascent technology, CacheFlow's focus was primarily on caching static content.

Hawthorn joined the company as it entered the UK in 1998, the year before its IPO. The IPO was a tremendous success, one of the most successful of the era. At the time Akamai was trading at 637 times its own IPO value, primarily because so much value was foreseen in internet caching technologies, and this undoubtedly helped CacheFlow achieve a price at the top of the internet boom.

As CNET reported at the time:

Internet firm CacheFlow today jumped out of the IPO starting gate, with shares racing ahead fivefold on the company's first trading day.

Shares in the company, which markets appliances designed to accelerate the delivery of information on the Internet, opened at $110--far above its IPO price of $24. The stock ended the day up $102.75 to $126.75--an increase of more than 428 percent--on 7.3 million shares. At today's closing price, the company claims a market capitalization of more than $4 billion.

CacheFlow had increased its pricing range to $18 to $20 a share from $11 to $13, as investor interest in firms that help eliminate data congestion on the Net had lately been overwhelming.

It is also interesting that Netscape's Marc Andreessen was one of the pre-IPO investors and directors, showing the company's pedigree even at the outset.

Well-capitalised and well-positioned in a blossoming market, the company then set about its international expansion and strengthening its position with a series of intelligent acquisitions. Notably, the 2000 acquisition of Entera added a wider range of streaming protocols, including Windows Media and QuickTime, to the CacheFlow offering. extending what had been a Real-Networks-only product set.

Adding Security to the Optimization Mix

In some ways, that's where the evolution of the company's streaming product set slowed for some time-perhaps until the press release in October 2010, which I will cover a little later in this article.

Hawthorn made some mention of this when we spoke: "As the dot-com boom blew itself out, efficiency and performance in the face of the formerly-anticipated growth became less of a priority for our customers. However we (and they) noticed that our placement in the network was strategically optimal for the deployment of security focused technology." The dot-com bust years bore this increased focus on security out with their acquisition of antivirus hardware vendor Ositis and URL filtering software vendor Cerberian.

This focus on security continued through to the end of 2008 when the acquisition of Packeteer broadened the reach a little to include WAN optimization, and to some extent a re-focus on the companies focus on aspects of delivery.

So while the company, which rebranded itself as Blue Coat in 2002, has travelled a long way in the past decade it and a half, it has maintained the offering of streaming-related technologies, but realistically, until this year their kit has only supported Real, then RTSP/QuickTime, Windows Media, and beyond that nothing. Flash has been limited to progressive download (HTTP).

The "Dot-TV" Boom

With the rapid growth of video (I like to call it the "Dot-TV Boom") in the past few years, enterprises and carriers (Blue Coat's core markets) have suddenly been faced with the reality that they had dreamed of in the heady days of Blue Coat's initial IPO: Huge, expensive demand for networks for online video and audio. And Blue Coat has been there to address that market. As Nigel says "it's in our DNA."